As more people look for financial advice online, brick-and-mortar wealth management firms and financial advisors are competing harder than ever for search customers. More than 70% of millennials use search engines for research, and 15% of 18–34 year-olds are turning directly to search engines for financial advice. As consumers in their 20s and 30s grow their wealth, have families, and begin planning for the future, who is best situated to capture their attention online?

This turns out to be a more difficult question than you might think. Focusing on Google, there are three major areas where financial service providers can compete: organic results, local results, and paid results (ads). Even organic results are increasingly localized, with top rankings varying wildly from city to city, and traditional organic results are often pushed below both ads and the local 3-pack. Local packs command a large amount of screen real-estate — here’s a local pack for “financial planner” in my own suburban Chicago neighborhood:

In partnership with Hearsay Systems, which provides Advisor Cloud solutions for the financial services industry, we decided to find out who’s leading the pack (no pun intended) in 2017 for wealth management and financial advisory searches across organic, local, and paid results.

Research methodology

For the purposes of this study, we decided to target five keyphrases related to wealth management and financial advisory services:

- financial advisor

- financial planning

- financial planner

- financial consultant

- wealth management

For each keyword, we looked at page one of Google results across 5,000 cities (the 5K largest cities in the contiguous 48 states, according to US census data). We then captured URLs and ranking positions across organic, local, and paid results.

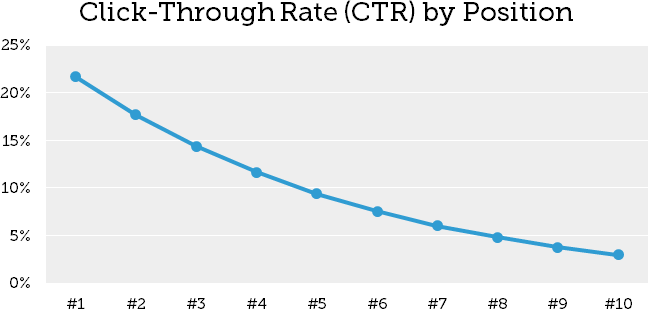

To aggregate the data, we weighted each result by the population of the corresponding city and the estimated click-through rate (CTR) of its ranking position. We used a fairly conservative CTR curve, weighting top results a bit heavier, but not too dramatically:

For the final analysis across all five keywords, we weighted each keyword by its estimated search volume (according to Google Adwords) in the United States. By far, “financial advisor” was the most popular keyword, scooping up about 55% of search share across the keyword set.

Since some large brands use multiple websites (domains), we consolidated their numbers across those domains. So, for example, morganstanley.com and morganstanleybranch.com were grouped together in the final analysis. Quite a few brands have separate domains for their corporate site and local/branch locations. We’re interested in the strength of the brands themselves, not the particulars of how they divvy up their websites.

Top 5 organic leaders

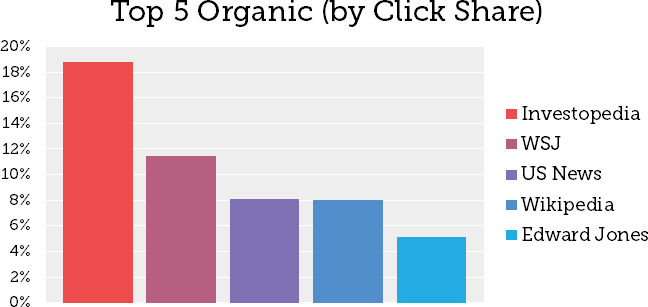

The Top 5 for organic results were dominated by informational and news sites. The following graph compares the total “Click Share” based on all available clicks across all sites:

Investopedia led the way, scoring almost one-fifth of all clicks in our aggregate model, across more than 4,000 ranking domains. Among major players in the financial services space, only Edward Jones made it into the Top 5.

This is consistent with the idea that people are seeking general financial advice, and may not always be looking to organic results to find local service providers. Google’s results can often tell us a lot about how they’re interpreting search intent.

Curious case of keyword #4

Across the five keywords, we generally saw similar patterns. There were ranking variations, of course, but most of the top sites for one keyword performed well across the other keywords in organic results. The notable exception was keyword #4, “financial consultant.”

The Top 10 organic competitors for “financial consultant” included Monster.com (#1), Indeed.com (#4), Glassdoor (#5), and Robert Half (#7). Google seems to be interpreting this search as a job-hunting search and not a search for a service provider. This goes to show how important it is to make sure you’re targeting the right terms.

Top 5 local leaders

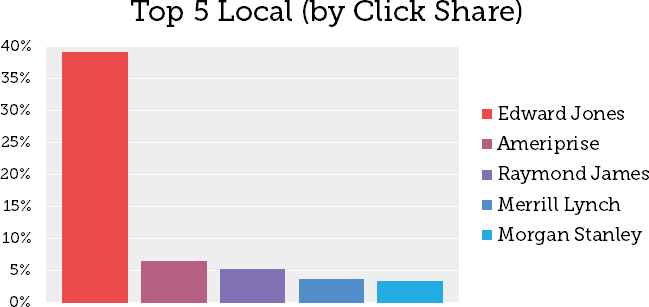

Applying the same analysis to the local pack, we came up with the following Top 5…

Traditional wealth management players performed much better in local pack results. Across our data, though, Edward Jones dominated the competitors in local rankings, consuming almost 40% of the total Click Share.

Interestingly, there was more overall diversity in local pack results, even with one dominant player and only three ranking positions per page. While just over 4,000 different domains ranked across organic results, local packs in our data set sampled from almost 7,000 different domains.

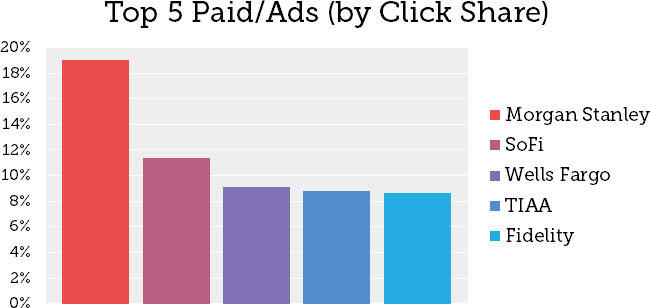

Top 5 paid/ad leaders

Morgan Stanley led the way in paid positioning, capturing just under 20% of Click Share. The rest of the Top 5 paid players were a bit more well-rounded, consuming roughly equal shares...

Interesting to note that relative newcomer SoFi seems to be spending pretty heavily in the space. SoFi (“Social Finance”) is an online finance community clearly aimed at the digital generation.

Given that this is a competitive space with relatively high costs-per-click (CPC), only 366 domains appeared in paid listings in our study. This was not due to a lack of ads — over 99% of the search results we examined displayed ads, and almost every search had a full complement of seven ads.

Non-traditional players

In addition to SoFi, a couple of newcomers fared pretty well in our data relative to their size and spend. Betterment.com appeared in 25th place in organic and 16th in paid. NerdWallet came in 46th in organic results and 22nd in paid. Credio.com took 20th place in organic overall but had no paid presence.

The one advantage traditional players clearly still have is in local results, where none of these newcomers ranked. Big brands with multiple brick-and-mortar presences still dominate local pack results, for obvious reasons, and online-only players can’t compete in local/map results. This makes performing well in local results even more important for big brands with a strong, nationwide physical presence.

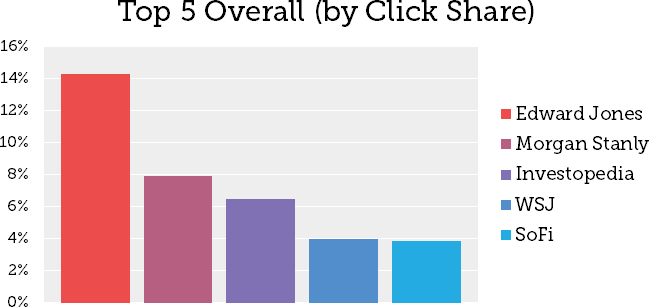

Big winner: Edward Jones

Squeezing a lot of data into one graph can be a little dangerous, but let’s take a peek at what happens when we aggregate across all three types of listings (organic, local, and paid). Here are the Top 5 across all of the data in our study…

The combination of their dominant #1 position in our local data, #5 in organic, and a solid #25 in paid makes Edward Jones the clear overall winner, grabbing just over 14% of total Click Share in our study. Industry powerhouse Morgan Stanley comes in at #2, thanks primarily to their #1 paid ranking and #5 local position.

What’s the secret to Edward Jones’ success? Despite what the Internet wants you to believe, there’s almost never just one weird trick to search marketing success in 2017. One significant factor may be that Edward Jones has gone all-in on hyper-local pages. Their dominant local presence was made up of over 7,000 unique URLs representing their individual advisors.

Each advisor page has a clear, consistent Name, Address, and Phone number (or “NAP,” to use local search lingo), office hours, and other essential information. While the pages aren’t particularly unique, Edward Jones has done a good job of making sure that local offices are well represented and have a consistent, structured page.

It’s worth noting that even local rankings are very keyword specific. While Edward Jones ranked #1 overall in local packs for all four keyphrases starting with “financial…”, they fell to #23 for “wealth management.” Edward Jones has clearly carved out their niche.

The Wall Street Journal, on the other hand, maintains their dominant organic position with just a single page: a guide to choosing a financial planner. This page clearly benefits from WSJ’s overall authority, and it shows just how different ranking for organic and local search has become these days.

A few tactical takeaways

Based on this research, what advice would we give to financial players (big and small) who hope to be competitive in Google search?

Brick-and-mortar should focus on local

The big financial players with physical offices need to capitalize on that fact, because online-only players won’t be able to compete in local results (at least for now). While a hyper-local approach (to the tune of thousands of pages) is a big undertaking and not without risk, I’d highly recommend testing it if you’re a big player in the space. Edward Jones’ success with this approach can’t be ignored.

For local, focus attention on key markets

You don’t have to compete in every market (you’re probably not even physically in every market). Across even five keywords and 5,000 cities, there were roughly 7,000 domains ranking in the local 3-pack. That means that the winners for any given market varied wildly. Invest your hyper-local resources in key markets with the highest potential ROI.

Online-only should invest in content

Sure, the Wall Street Journal is a huge player, but the fact that they ranked across thousands of cities and highly competitive keywords with a single piece of content is still pretty amazing. Google seems to be interpreting these keywords as informational, and so online-only players need to invest heavily in content that hits the research phase of the buyer cycle. If big financial players hope to compete for organic, they may have to do the same.

You may have to pay for placement

I’ve worked in paid search in a former life, and I believe a balanced approach to search marketing has to be an eyes-wide-open approach. Right now, ads have prominent placement on these searches, often with a full seven ads per page (including four at the top). If you have the money and want to compete against organic and local pack results, you have to at least run the numbers on advertising.

Special thanks to our partners at Hearsay Systems for their industry expertise and contributions to planning this project and analyzing the data. Hearsay provides Advisor Cloud solutions for the financial services and insurance industries.

Great post. I am looking for some clarification, however, regarding what Edward Jones does with the GMB listings. It appears to me they are violating GMB guidelines by keyword stuffing "Financial Planner" in the title. It was my understanding that placing service information about the business violates GMB guidelines. Google also states the proper way to name a solo practitioners that belong to branded organization:

"If a practitioner is the only public-facing practitioner at a location and represents a branded organization, it's best for the practitioner to share a listing with the organization. Create a single listing, named using the following format: [brand/company]: [practitioner name]."

My question: Are they in violation of these GMB guidelines?

I admit I'm not an expert on GMB guidelines, but it appears that you're right -- they may be pushing policy limits on that one. Looking at their location pages, it mirrors their organic naming conventions, so it may be unintentional, but it certainly could be giving them a boost. Hopefully, someone with a bit more local SEO expertise can chime in.

I've seen similar examples of GMB title keyword stuffing, resulting in the GMB listing appearing for broad generic queries. It's not widespread and I'm hard pressed to find another example of a similar query, but has anyone seen this happening before as well?

Hi Pete!

One of the most interesting takeaways for me in this was that there was almost twice as much domain diversity in the local results as there was in the organic results. I'd hypothesize that this may indicate the difference between the organic and local ranking factors. Organic is one set, and while local has them all, it also has its own factors that further diversify results. So, for example, 400 domains have build enough authority to consistently rank in the organic results for the 5 keyword phrases, but new factors come into play when it comes to the local packs, and that results in a broader mix of winners. Such interesting data and a very worthwhile study!

Interesting article. About the keyword: financial consultant.The keyword is a service and not a job and the Google believes that is a job.

Unfortunately, what matters from a search standpoint is Google's interpretation, whether or not we agree with it, and Google is interpreting intent more and more often. They may have their reasons or they may have screwed it up, but either way it's the reality we're left with.

'Google believes that is a job'. In my opinion it gives a very interesting clue about what users do when searching for financial consultant.

Where users click when they search for financial consultant and spend more time after that search? Probably in job webs, so they apper in the top of the rankings.

Indeed a great post!

Things that attracted my attention:

1. Detailed analysis of the long list of keywords and domains across 5000 cities

2. Rather I should say that a "Google's confusion" or the lack of understanding the intent behind the keyword - "financial consultant". Most people look for such jobs rather for an actual search of a financial consultant. We need to be very careful at this kind of keyword research mistake.

3. All 4 tactical takeaways - This explains it is better to always ensure to be one step ahead of your competitors through all ways of marketing.

Thanks for sharing, Dr. Peter!

Great report. Is there any way to do something simmilar for other searchs or places? What tools could you use to get and analyse the data?

I was wondering what's best for online-only website. Glad to find out (based on the data) that the best thing is investing in content in general. Martin

Superb study Dr. Meyers. Crazy to see Edward Jones dominating in such a way, definitely agree that investing in content is a huge factor and it's interesting to see that Edward Jones' ranking for financial advisor are so different than their rankings for wealth management, since I would assume they are LSIs of each other. Thanks for sharing your report!

Usted cree que es importante para geolocalizar sus datos para su local de SEO

Regards peter and nice article!

Interesting post. The research methodology is too good and great way to gathered all the information.. Thanks for sharing, it's really helpful to people when find online financial advice..

Which is more competing to this day?

Local or global keywords?

I think there is more battle in the local searches or that you are employing an SEO more black than white

It depends on any project, but there's a big part of the pie in local seo and local keywords.